Claire*, 42, was always told: “Follow your dreams and the money will follow.” So that’s what she did. At 24, she opened a retail store with a friend in downtown Ottawa, Canada. She’d managed to save enough from a part-time government job during university to start the business without taking out a loan.

For many years, the store did well – they even opened a second location. Claire started to feel financially secure. “A few years ago I was like, wow, I actually might be able to do this until I retire,” she told me. “I’ll never be rich, but I have a really wonderful work-life balance and I’ll have enough.”

But in midlife, she can’t afford to buy a house, and she’s increasingly worried about what retirement would look like, or if it would even be possible. “Was I foolish to think this could work?” she now wonders.

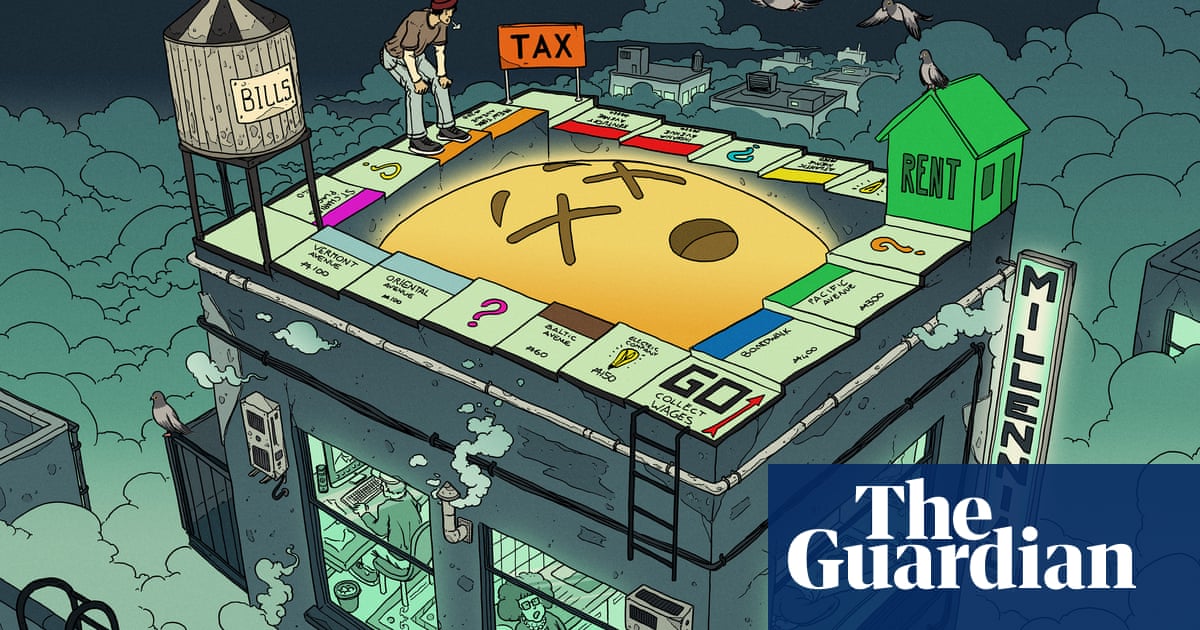

She’s one of many millennials who, in their 40s, are panicking about the realities of midlife: financial precarity, housing insecurity, job instability and difficulty saving for the future. It’s a different kind of midlife crisis – less impulsive sports car purchase and more “will I ever retire?” In fact, a new survey of 1,000 millennials showed that 81% feel they can’t afford to have a midlife crisis. Our generation is the first to be downwardly mobile, at least in the US, and do less well than our parents financially. What will the next 40 years will look like?

Hell. Gen X also are worried about retirement.

Will social security be here in 15 years? My 401k has not kept up at all… Everything today costs soooooooo much there’s no real room for saving.

Right??

Early Gen Z / very tail end of millennial here.

Got a job that pays ~80k (with promotion potential to 100k in a year) and I’m just… dumbfounded at how yall are making it. I didn’t grow up wealthy at all, and struggled with homelessness for a time, so I’m not new to the frugal game, but being able to put away only a hundred or two bucks a month after taxes is crazy with the hours and time I put into existing. I’d rather just not work at all if the end result is the same.

Doordash is a crux in my life and something I’ve definitely splurged on in the past, but groceries are just as expensive outside of rice beans and chicken. Baffling. :(

Every little bit helps. Future you will thank you for even putting that amount away.

I try, but of course life finds a way to rip whatever savings I’ve got slowly but surely.

At this point, I’m still looking at working till the day I die.

Most recent social security trustees report says the trust fund will run out in 2035. What happens in 2035? Benefits are still funded at 83% in perpetuity. By the way, last year it was going to run out in 2033, and the year before that it was going to run out in 2031. And also by the way, the trust fund was specifically set up because they knew the baby boomers were going to stress the system, so it’s supposed to get depleted as the boomers use it.

Everything is working mostly as intended, and yet there’s all this anxiety around Social Security. Why? Because Republicans want you to think Social Security is fucked all on its own so that you don’t question it when they ratfuck it. That and they want to constantly frame the conversation as such so that the conversation doesn’t turn to “how do we make social security more robust and generous?” or some other radical socialist nonsense.

What do you invest your 401k in?

Early Gen X, late millennial here. This, wondering how we are going to pay for the skyrocketing health care, day to to living, and send our kids to school. We are told to invest in 401k’s which after living through the dot com bust and housing crash, is a total fucking gamble. How are we going to live? I.have.no.fucking.idea. To be blunt, this country just doesn’t give a fuck, I expect to be working until I die.